Trucks are the lifeblood of commerce, moving goods across vast distances to keep our economy running. For fleet managers and owner-operators, efficiency is not just a goal—it's a necessity. Fuel management is a critical component of running an efficient fleet, and it can make a huge difference in a fleet's profitability.

Fleet fuel cards have long been a staple tool for managing fuel expenses, offering a way to streamline purchases and track spending. However, as the industry evolves, so must the solutions we use to manage our fleets.

Forward-thinking managers should be looking for more advanced digital solutions that offer greater flexibility, security, and integration with their fleet management systems. The right fuel payment solution is a strategic advantage; it can help retain drivers by simplifying their on-road expenses (no personal card payments), reducing the risk of fraud, and providing valuable insights into your fleet's fuel consumption patterns.

Understanding Fleet Fuel Card Solutions

Fleet fuel cards are specialized credit cards designed to help businesses manage and track fuel expenses for their vehicle fleets.

These cards serve multiple purposes:

- Simplified Purchasing: Drivers can easily purchase fuel and other approved items without carrying cash or using personal credit cards.

- Expense Tracking: Fleet managers can monitor fuel purchases in real-time, making it easier to track spending and identify unusual patterns.

- Cost Control: Many fleet cards for fuel offer fuel discounts at partner stations and allow managers to set spending limits.

- Reporting: Detailed reports on fuel consumption and spending help in budgeting and identifying areas for improvement.

Types of Fleet Management Fuel Cards Available

- Commercial Fleet Fuel Cards: These are designed for businesses with larger fleets. Commercial fleet fuel cards usually offer more comprehensive features and reporting capabilities. This is typically a physical card.

- Trucking Fuel Cards: Specifically tailored for long-haul trucking operations, trucking fuel cards typically have a wide acceptance network at truck stops and offer additional benefits like shower credits or loyalty points. They are also physical cards.

- Digital Fuel Payments: These solutions often come in the form of mobile apps or integrated fleet management systems that allow for contactless payments at gas stations. Digital payments can use advanced encryption and authentication methods, reducing the risk of fraud. Transactions are instantly recorded and synced with fleet management systems, providing up-to-the-minute insights without carrying physical cards. This also completely eliminates the risk of card skimming.

If you were to rank fleet fuel payment options, it would look something like this:

- Digital fuel payments by far rank the highest, offering everything a traditional fleet fuel card would, without the potential to be lost or stolen.

- Commercial and trucking fleet fuel cards are superior to traditional payment options since they were built with fleet management in mind.

- Traditional payment methods are your lowest tier, as they lack the necessary functionality to serve this industry.

As we explore the key features to look for in fleet management fuel cards and alternative options, it's important to consider how a digital solution could elevate your fleet's overall fuel management strategy.

|

|

Fuel Cards

|

Fleet Checks

|

|

|---|---|---|---|

| Vulnerable to card skimming, fraud, and hacking |

|

|

|

| One-time digital codes that work at the pump and in-store |

|

|

|

| Centralized reporting for all fuel and other OTR transactions |

|

|

|

| Fraud prevention through customizable policies and prompts |

|

|

|

| Instant activation for your entire fleet using a mobile app |

|

|

|

| Geofencing for accurate location verification on transactions |

|

|

|

Key Features to Look for in Fleet Fuel Cards and Alternative Options

1. Fuel Network Coverage

One of the most critical factors in choosing a fleet fuel credit card is where the card is accepted. The ideal network should align with your fleet's operational footprint, whether that's nationwide, regional, or local.

Importance of a Broad Network for Nationwide or Regional Operations

For fleets that operate across state lines or cover large regions, you want a fuel card with a vast network of stations. This ensures that drivers can easily find approved fueling locations without deviating significantly from their routes, saving time and reducing out-of-network charges.

Considerations for Rural vs Urban Fueling Needs

Where your fleet operates will dictate the type of network coverage you need. Urban fleets might prioritize cards accepted at a variety of local stations, while rural operations may need cards that work at truck stops and independent stations in less populated areas.

Different Fuel Types

A comprehensive fuel card solution should cater to all the fuel types your fleet requires. This is particularly important for mixed fleets or those with specialized vehicles.

Common fuel types to consider:

- Diesel: The primary fuel for most trucking fleets

- DEF (Diesel Exhaust Fluid): Essential for many modern diesel fuel engines

- Reefer: Fuel for refrigerated trailers

- Gasoline: For smaller vehicles in the fleet

Other Transactions that Fleet Management Fuel Cards Cover

While "fleet cards for fuel" imply a focus on fuel purchases, modern cards cover a range of over-the-road expenses. This comprehensive approach can simplify expense management and provide a clearer picture of total fleet costs.

Common non-fuel expenses include:

- Maintenance and repairs

- Truck washes

- Tolls

- Parking fees

- Driver per diems

2. Integration and Compatibility

Compatibility with Fleet Management Software

Many fleets already use comprehensive fleet management software to track vehicles, manage vehicle service schedules, and monitor driver performance. This technology allows fuel consumption data to be correlated with route information, vehicle performance metrics, and driver behavior, among other things.

The best fuel fleet card should offer seamless compatibility with your fleet management software. This connection reduces administrative burdens by automating data entry and reconciliation, minimizing errors and saving time.

When evaluating integration capabilities, consider:

- Whether the fuel card provider offers APIs or pre-built integrations with popular fleet management software

- The depth of integration possible (e.g., real-time data sync vs. daily batch updates)

- Any additional costs associated with integration

For reference, the following fleet management software are among those that offer fuel card integrations:

- Samsara

- Geotab

- KeepTruckin

- Verizon Connect

- Teletrac Navman

- Fleet Complete

- Omnitracs

- GPS Insight

- Trimble Transportation

- Fleetio

Beyond fleet management software, consider how a fuel card solution might integrate with other business systems:

- Accounting software: For seamless expense tracking, easy processing of driver reimbursements or per diems, and financial reporting

- ERP systems: To incorporate fuel data into broader business analytics

The Importance of Data Syncing in Integrations

Effective fuel management relies on accurate, timely data. The best fuel card solutions offer robust data syncing capabilities with your FMS (fleet management software).

Look for:

- Real-time transaction data, including location, time, fuel type and quantity, with immediate visibility into fuel purchases as they occur

- Automated mileage tracking that integrates with GPS or telematics systems to calculate fuel efficiency

- Customizable alerts with notifications for unusual spending patterns or low fuel efficiency

- Ability to tag transactions with vehicle or job information

- Customizable reporting tools to analyze fuel consumption trends

Accessibility and User Interface

The usability of a fuel card system can significantly impact its effectiveness and adoption rate among drivers and managers. Drivers have enough on their plates every day, so their employers should choose fuel cards that are easy and intuitive to navigate.

Putting the driver experience at the forefront, trucking companies should seek out fuel cards that offer:

- Simple payment process at the pump

- Clear instructions on accepted locations and purchase types

- Easy access to account balances and transaction history

For fleet managers, that means:

- Intuitive dashboard for monitoring fleet-wide fuel usage

- Simple tools for setting and adjusting spending limits

- Easy process for adding or removing cards

In our increasingly mobile world, companies should be able to access fuel card data in the palm of their hand.

Look for solutions that offer:

- Mobile apps for both iOS and Android devices to support drivers out on the road

- Responsive web portals accessible from any device, for both drivers and fleet managers

- Real-time notifications and alerts that keep the driver and office connected

3. Security

Security features are crucial for fleet fuel cards because they help prevent fraud and unauthorized transactions from things like card skimming, ensuring that only authorized personnel can use the cards.

These features enhance control and accountability. By monitoring fuel purchases and setting spending limits, fleet managers can detect and address any irregularities promptly, ultimately protecting the company from financial losses and ensuring efficient fuel management.

Transaction Controls

Robust transaction controls can significantly reduce the risk of misuse or fraud. By setting specific limits on transactions, like the amount of fuel that can be purchased, the time of day when purchases can be made, and the types of fuel that can be bought, businesses can significantly reduce the risk of unauthorized or excessive spending

These controls include:

- Setting daily, weekly, or monthly spending caps

- Limiting purchases to specific hours or days

- Geo-fencing purchases to approved areas

- Limiting purchases to specific fuel types or categories

- PIN protection for all transactions

- Two-factor authentication for account access

- Real-time alerts for unusual activity

- Ability to instantly freeze or cancel cards

Advanced/fuel card systems offer sophisticated monitoring tools:

- AI-powered anomaly detection

- Pattern recognition to identify potential misuse

- Detailed audit trails of all card activity

- Regular security reports and updates

Because fraud can be so corrosive to your fleet’s profitability, a fuel card that actively helps you eliminate fraud can save you thousands per month, and savings will grow with the size of your fleet.

Customizable Fuel Controls

Clear driver policies prevent misuse and create spending controls. They establish clear guidelines and expectations for fuel card usage, ensuring that all transactions are authorized and legitimate. These policies specify who can use the cards, for what purposes, and under what conditions. They also promote accountability by requiring drivers to document and report fuel purchases accurately.

Key elements of effective driver policies include:

- Clear guidelines on approved purchases

- Procedures for reporting suspicious activity

- Requirements for collecting and submitting receipts for physical card holders

- Consequences for policy violations

- Training on efficient driving practices to maximize fuel economy

Consider fuel card solutions that support policy enforcement through:

- Automated policy reminders sent to drivers

- Digital acknowledgment of policy terms

- Integration with driver training modules

4. Cost and Fee Structure of Fleet Fuel Cards

The cost and fee structure of fleet fuel cards can vary between providers, and it's important to carefully evaluate these aspects to ensure you're getting the best value for your business.

Fuel Pricing

Fuel pricing directly impacts your bottom line. Most fleet fuel card providers offer discounted fuel rates compared to retail prices, but the specifics can vary.

Some cards provide a fixed discount per gallon, while others offer tiered pricing based on volume. It's important to understand how these discounts are applied and how they compare to regular pump prices.

Look for solutions that offer:

- Transparent pricing models

- Clear breakdown of prices at retail fuel locations vs. discounted prices

- Volume-based discounts for larger fleets

- Ability to lock in fuel prices for future purchases

- Discounts and savings through preferred networks

- Evaluate the locations and quality of partner stations

- Compare discount rates across different providers

- Detailed transaction reports showing base price and all applicable fees

- Clear explanation of how discounts are applied

- Regular summaries of savings achieved through the program

5. Fee Structures

In addition to fuel pricing, fleet fuel cards often come with various fees that can impact the overall cost of the program. These fees may include one-time, recurring, and usage-based charges. Understanding the full fee structure is crucial for accurately comparing different fleet fuel card options and determining the true cost to your business.

Understand all potential fees associated with the fuel card program:

- Annual or monthly fuel card fee per driver

- Per-transaction fees

- Network access fees

- Account maintenance fees

- Fees for additional services (e.g., reporting, integration)

Compare the total cost of ownership across different solutions, considering both direct fees and potential savings. Some fuel card providers offer attractive rebate options of X cents per gallon, but these savings can be partially offset by their fee structure, so pay close attention to both.

6. Customer Support and Service

Strong customer support is vital to any fuel card service. Immediate support addresses security concerns like fraud by enabling prompt card blocking and replacement and also supports drivers by giving them the help they need when they need it.

Availability of 24/7 Support for Emergencies

Given the round-the-clock nature of many fleet operations, look for providers offering:

- 24/7 phone support for urgent issues

- Multiple support channels (phone, email, chat)

- Dedicated support for managers vs. drivers

Responsiveness and Expertise in Resolving Issues

Evaluate potential providers based on:

- Average response times

- Resolution rates for common issues

- Availability of knowledgeable support staff familiar with fleet operations

Speed of Activation

Delays in activation can lead to increased fuel costs or cash flow issues if employees resort to using personal credit cards or cash for fuel purchases in the interim, which complicates expense tracking and reimbursement processes. Moreover, rapid activation ensures that fleet vehicles can refuel without interruption, maintaining productivity and minimizing downtime.

Look for:

- Quick turnaround time for new card requests

- Availability of temporary digital cards while waiting for physical cards

- Process for emergency card replacement

Make the Best Fuel Card Decision

Choosing the right fleet fuel card solution is a critical decision that can impact your fleet's efficiency and bottom line. Multiple factors must be considered, from network coverage and integration capabilities to security features and cost structures.

While traditional fleet fuel credit cards continue to offer valuable benefits, the industry is rapidly moving towards more advanced digital payment solutions. These digital options often provide enhanced security, real-time data access, and seamless integration with other fleet management tools.

Ultimately, the right fuel payment solution should do more than just facilitate purchases—it should be a strategic tool that provides valuable insights, enhances security, and contributes to your fleet's overall efficiency and profitability.

Take the time to assess your options thoroughly, involve key stakeholders in the decision-making process, and don't hesitate to request demos or trials from potential providers. With the right solution in place, you'll be well-positioned to fuel your fleet's success.

Get Relay Payments: The Modern, Secure Fuel Card Option

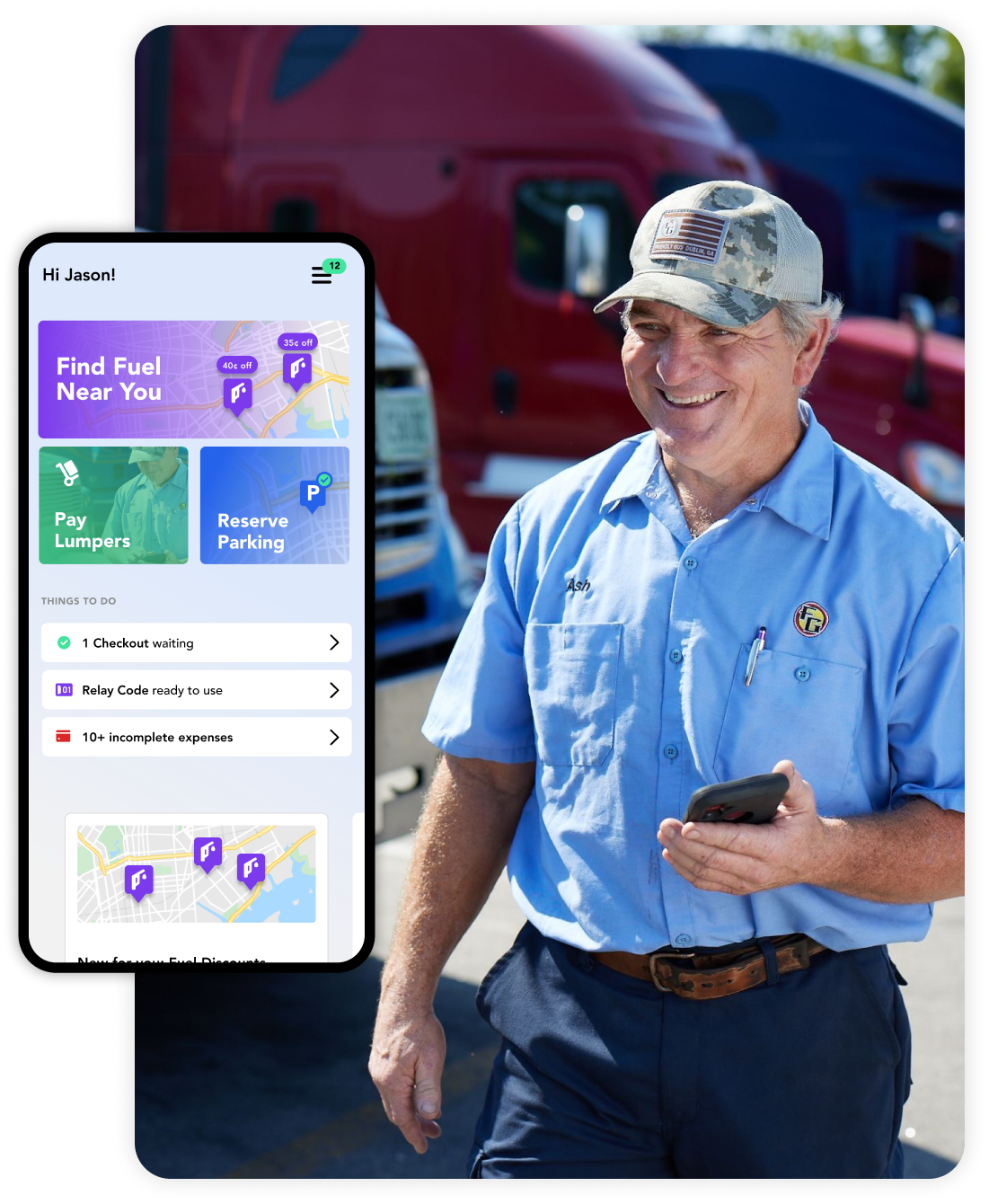

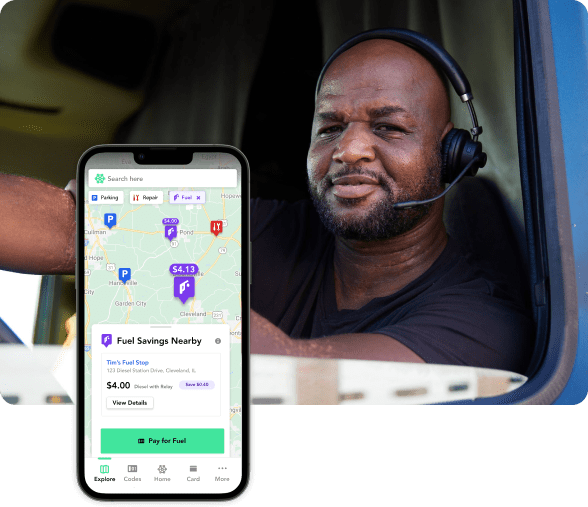

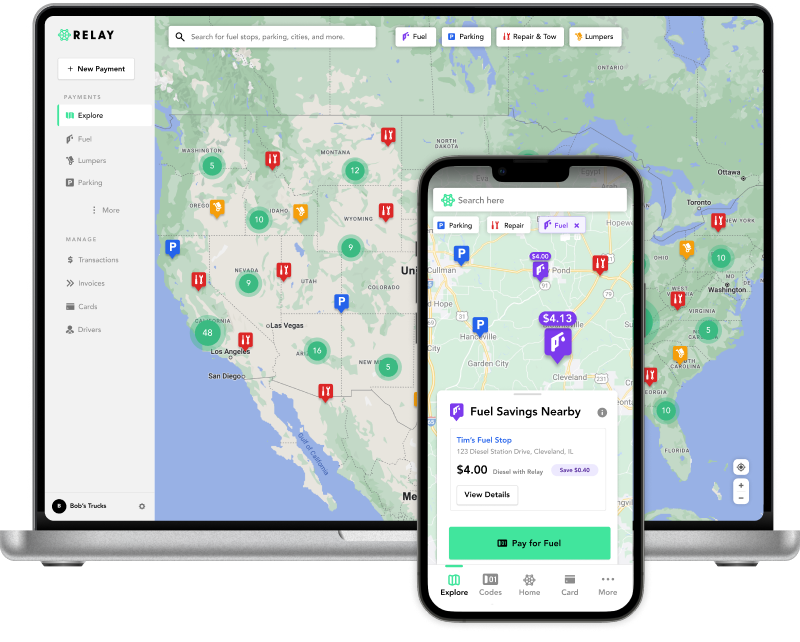

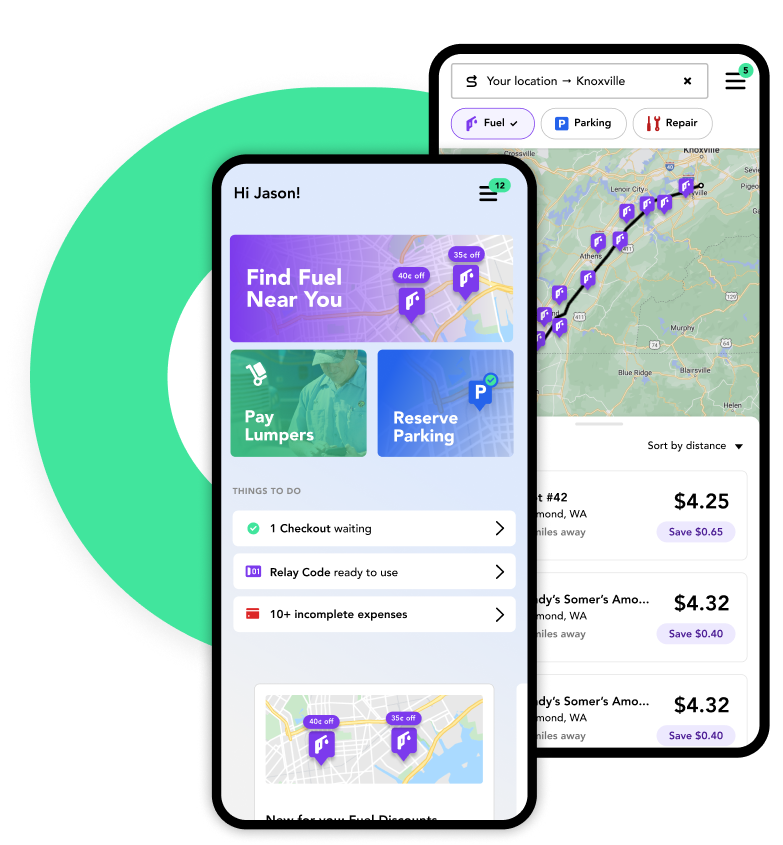

Ready to revolutionize your fleet's fuel management? Don't let outdated payment methods hold you back. Explore Relay's cutting-edge digital payment solutions designed specifically for the trucking industry. Relay can drastically improve the way you pay for fuel and maintenance costs, centralizing OTR payments in one place.

Our digital payments are instant and secure, putting time back in your drivers’ day so they can spend more time on the road. Fuel or fleet managers can instantly view payments, which we empower with more controls to manage spend. Our mobile app helps drivers find merchants on their route and issue seamless payments as they go.

Take the first step towards optimizing your fleet's efficiency and profitability. Contact Relay today for a personalized demo and discover how our innovative solutions can drive your fleet forward. Don't just fuel your trucks—fuel your success with Relay.